RiskCALM4® – An Uncommon Solution

Compliance – Competition – Cyber Threats – Portfolio Risk

IT’S MORE THAN IFRS 9

According to the CAB magazine issue of 2016, excerpts from the CAB Chairperson message describing the state of banking in the Caribbean, as follows:

Correspondent Banking

“Compliance with the ever-changing regulatory framework has become a blueprint for survival for financial institutions. In the aftershock of the Great Financial Crisis (GFC), we saw the evolution of myriad regulations such as: AML, CTF, FATCA, US Dodd Frank Act, CRS and the BASEL Accords, all aimed at promoting better risk management and a more robust financial system that underpins strong and sustainable economic growth.”

Compliance

“Compliance with the ever-changing regulatory framework has become a blueprint for survival for financial institutions. In the aftershock of the Great Financial Crisis (GFC), we saw the evolution of myriad regulations such as: AML, CTF, FATCA, US Dodd Frank Act, CRS and the BASEL Accords, all aimed at promoting better risk management and a more robust financial system that underpins strong and sustainable economic growth. We have also seen greater regulatory enforcement, with international banks being fined in excess of $161 billion between 2007 and 2015…Many are unable to afford the expensive and complex online systems to enable them to effectively and efficiently manage their risks. For example, the annual cost for an average size bank to implement and manage an online system can range from US$400 to US$1 million annually, including software licenses and staff for the compliance unit…The international drive for greater tax transparency and accountability has given rise to regulations such as the US Foreign Account Tax Compliance Act (FATCA) and the OECD Common Reporting Standards (CRS). Caribbean institutions have expended significant financial and human resources to develop the necessary infrastructure to comply, as non-compliance could result in heavy consequences, such as 30% withholding (FATCA) and, blacklisting of countries, which they can ill afford. It is noteworthy that lack of compliance with these regulations can exacerbate the de-risking situation by correspondent banks…”

Portfolio Risk

“Given the high delinquency ratios of banks in the Caribbean, one can safely predict that IFRS9, will have a significant negative impact on their balance sheet…, I encourage members who have not done so, to begin to review your risk appetite, credit management systems and also reevaluate your underwriting standards.”

Competition

“The Fintech revolution has been radically challenging and threatening to banks’ traditional roles as trusted intermediaries…New… cognitive computing, mobile and internet banking will certainly change the face of banking in the future, and I urge members to remain close to these developments as well as to customer demands, in order to be innovative, in a timely manner, to avoid your businesses becoming obsolete and extinct.”

Cyber Threats

“…Globally large organisations such as Mega Banks, SWIFT and certain Central Banks have suffered from highly sophisticated cyber-attacks. If these large organisations remain vulnerable to cyber-attacks despite spending millions of dollars on cyber security, then how do small banks with resource constraints weather the storm?”

It’s not common to find one solution that resolves these issues. Let us introduce you to:

RiskCALM4

RISK MANAGEMENT THAT

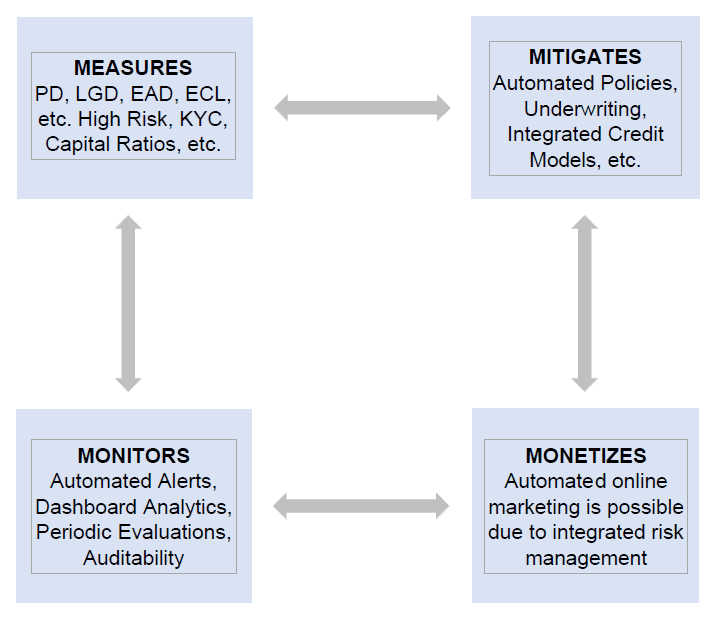

MEASURES – MITIGATES – MONITORS – MONETIZES

RiskCALM4 is the only solution available in the Caribbean marketplace that addresses all of the challenges identified by the CAB Chairperson, specifically:

- Correspondent de-risking. With the RiskCALM4 Solution a financial institution has auditable proof of their compliance with anti-money laundering, know your customer and counter terrorist financing requirements:

- Automates the Customer Identification Program (CIP), providing the capture and storage of information used to confirm the customer’s identity.

- Maintains business customer information, such as; target markets, number of customers, the jurisdictions in which they do business, their distribution channels, etc.

- Automates OFAC and sanctions check – each loan and deposit account opening the user is required to initiate the OFAC check.

- Automates Politically Exposed Person (PEP) list creation – On each loan and deposit account opening the user is required to initiate a search against the bank defined PEP list.

- FATCA – We capture the nationality of those who open deposit accounts as well as the SSN. This could be used to aid in identifying and reporting US citizens which have opened accounts.

- Compliance. IFRS 9 credit risk models fully integrated to the lending and finance requirements and processes. Includes:

- Creation of credit risks models specific to each bank.

- All IFRS 9 requirements PD, LGD, EAD and ECL.

- Provisioning amounts and the impact on capital requirement ratios.

- Ability to establish rules for re-checking status of individual customers and businesses through the repository of data retained.

- The re-calibrating risk models.

- Portfolio Risk. With RiskCALM4 IFRS 9 solution the loan portfolio can be analyzed automatically, and underwriting procedures and policies can be automatically managed in the lending module to manage the risk issues and the financial strategy of the bank. Identifying portfolio risk through stress testing based on rate adjustments and the impact to the portfolio.

- Competition. Due to the integration of the credit risk model and the technology available through RiskCALM4 through the loan and deposit and marketing modules, the financial institution has available:

- Online marketing of loans and deposits through website or business networks.

- Invocative selling through automated lifecycle financial analysis

- Cross-selling

- Automated promotions

- Monetizing current assets

- Predictable analytics

- Cyber security. With our cloud solution you have the best of both worlds; RiskCALM4 is managed by eCM Global and security is managed by IBM Cloud. While this is a major issue to the Caribbean financial system, it is also a concern globally. Small to medium size financial institutions have a difficult time balancing the cost of regulatory compliance with the cost of competing in the millennial induced online world. Technology is moving at a rapid pace, only out paced by the evolving regulations. Large institutions cannot keep pace, how are the medium to small affording to keep pace. Fortunately, the RiskCALM4 solution is a hosted solution that spreads the cost of infrastructure and security, and support across the customer base.

There are pivotal moments that all businesses face, if issues are answered correctly, those moments will become the pivotal point in time of your organization’s success. If leadership shrinks back by not seizing the moment, failure is crouching at the door. How a company responds will pretty much determine its success or failure. The diagram above identifies the four pillars of RiskCALM4’s risk management; measuring the potential risk level before it happens, mitigating the risk proactively, monitoring the policies and the mitigating processes to ensure adherence, while integrating risk management into the business processes of the bank and ensuring the monetization of the online marketing capability of the bank.

Leave A Comment